These loans are going to be thanks in a very set period or term, generally, between 18 months to five years, and they may have a fixed or variable curiosity charge. Commonly, there is a month-to-month or quarterly repayment schedule.

Sure. Cookies are small documents that a site or its services service provider transfers for your Laptop's hard disk through your Net browser (when you let) that enables the positioning's or company supplier's systems to recognize your browser and capture and keep in mind selected details. As an illustration, we use cookies to help us keep in mind and approach the merchandise within your searching cart.

Personal debt Consolidation: Refinancing existing debts at a decreased desire price to save on interest payments.

If we decide to adjust our privateness plan, We'll post those improvements on this site. Plan modifications will implement only to data gathered following the day on the change. This plan was past modified on June 11, 2013.

We reviewed in excess of 24 lenders centered on their charges and terms, repayment knowledge and customer support choices to provide you the seven very best solutions out there.

Their steerage by way of the whole process of obtaining approved was seamless. We have been incredibly grateful and sit up for working with them yet again Down the road.

A line of credit gives a ongoing source of credit supplied to shoppers by a lender or credit union. Providing you make payments punctually, you'll be able to preserve using your revolving credit again and again. After you repay Everything you’ve borrowed, the money develop into accessible once more.

If a business line of credit doesn’t seem to be the most beneficial fit to suit your needs, there are many different possibilities readily available, which include:

The moment a lender is selected, cash may be accessed in as minimal as 24 several hours, offering businesses a fast and flexible way to control hard cash circulation or include unpredicted expenses.

Your credit line equals your deposit with the option to graduate to an unsecured line of credit about timeadatext

To how to get working capital for a new business avoid these difficulties, work to construct up a very good credit score in your business and you. Have a devoted business banking account, and stay in addition to your payments.

Premiums for a business line of credit are typically lessen than These for the business credit card, which can charge much more than 20% APR for purchases — and more than that for income innovations.

Your credit line equals your deposit with the option to graduate to an unsecured line of credit around timeadatext

As opposed to ready weeks for loan acceptance, businesses have funds readily available straight away that has a revolving line of credit. This overall flexibility can make it a great economic Resource for rising businesses.

Val Kilmer Then & Now!

Val Kilmer Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Shane West Then & Now!

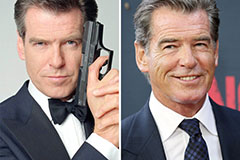

Shane West Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!